Stockpile launches family banking platform with kids debit card and tuition rewards for college savings

Stockpile, a company that provides fractional stock trading and gift cards redeemable for stock in the USA, has announced the launch of a new family banking platform.

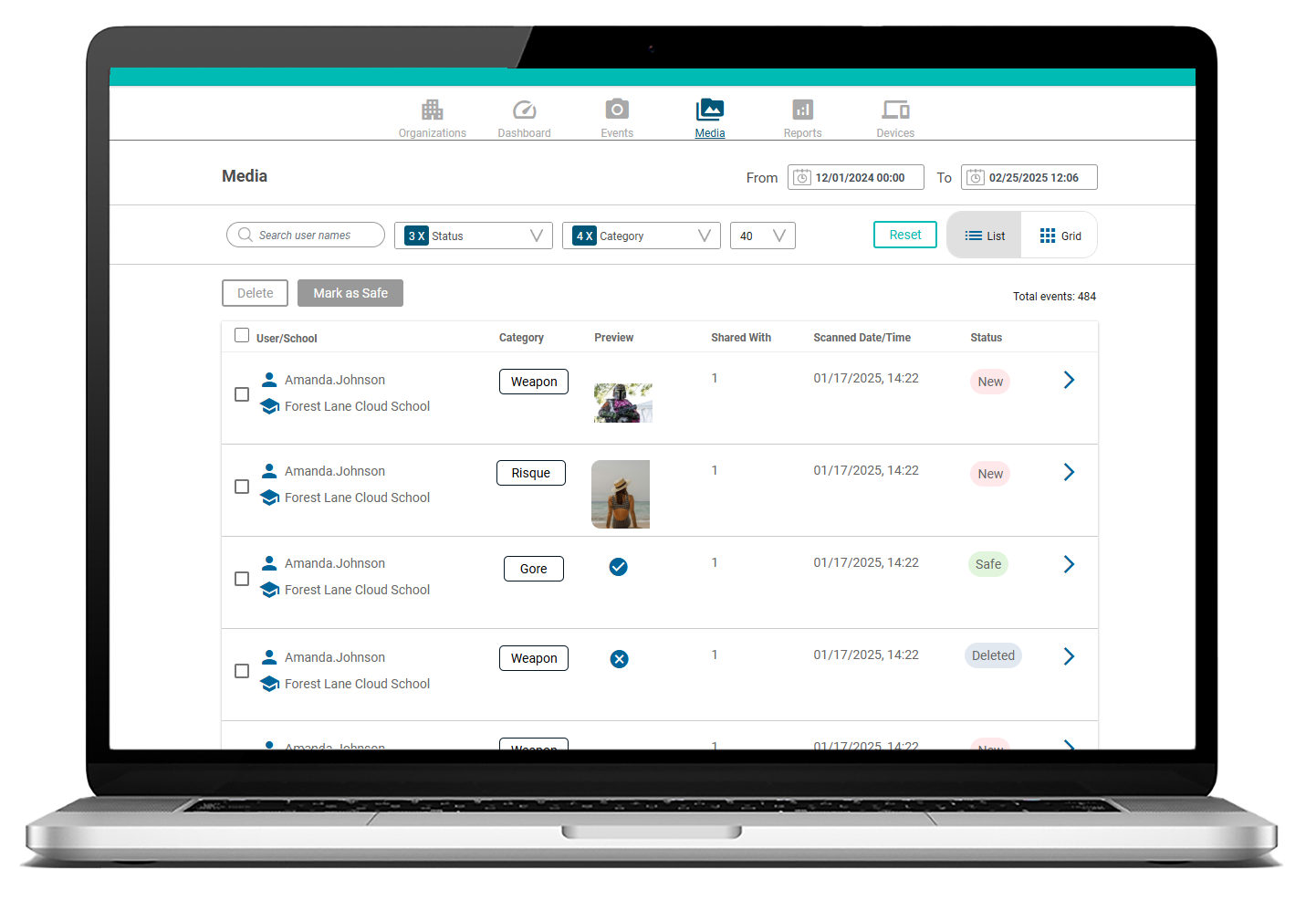

The platform includes a children’s debit card and a tuition rewards programme to help families manage their finances and save for college tuition.

The banking service, powered by Green Dot’s embedded finance platform, offers families a way to save, invest, and manage spending. Central to this offering is the Stockpile Tuition Rewards Programme, launched in partnership with SAGE Scholars Tuition Rewards.

The programme allows families to accumulate points that can be redeemed for tuition discounts at nearly 500 participating colleges and universities.

“We made investing easy and affordable for families, and now we're doing the same for banking while solving one of parents' top financial stressors — paying for college,” said Victor Wang, CEO of Stockpile."Our new platform is designed to tackle the college affordability crisis, offering families a simple way to plan for one of their largest future expenses.”

Stockpile’s tuition rewards programme is different from traditional rewards schemes that incentivise spending. Instead, it focuses on saving and investing. Families with a Stockpile Family Plus membership, which costs $7.95 per month or $69.95 annually, can earn up to 4,800 Tuition Rewards points each year. These points can be redeemed at participating colleges, with each point worth $1 toward tuition.

Financial education for families

The platform also aims to teach children financial skills through its app, which provides access to savings, investing, and budgeting tools. Young people can learn about the flow of money through a debit card linked to the Stockpile app, while families can focus on saving and investing.

“Giving kids their own debit card isn’t just about spending. It’s about teaching them the full circle of financial responsibility,” added Wang.

Stockpile’s family banking platform will launch in early 2025 in the USA.

“When kids see how saving, investing, and spending all connect through their card and app, they learn how to make financial choices that set them up for long-term success,” Wang said.