New Jersey Schools Insurance Group expands Origami Risk deal to include policy and billing

The New Jersey Schools Insurance Group (NJSIG) has selected Origami Risk’s cloud-based property and casualty (P/C) platform to support its policy administration and billing operations. The decision builds on an earlier implementation of Origami’s claims management system.

NJSIG is a self-insurance pool made up of approximately 365 boards of education and charter school districts. The group provides insurance coverage and risk services across multiple lines, including workers’ compensation, property, and liability.

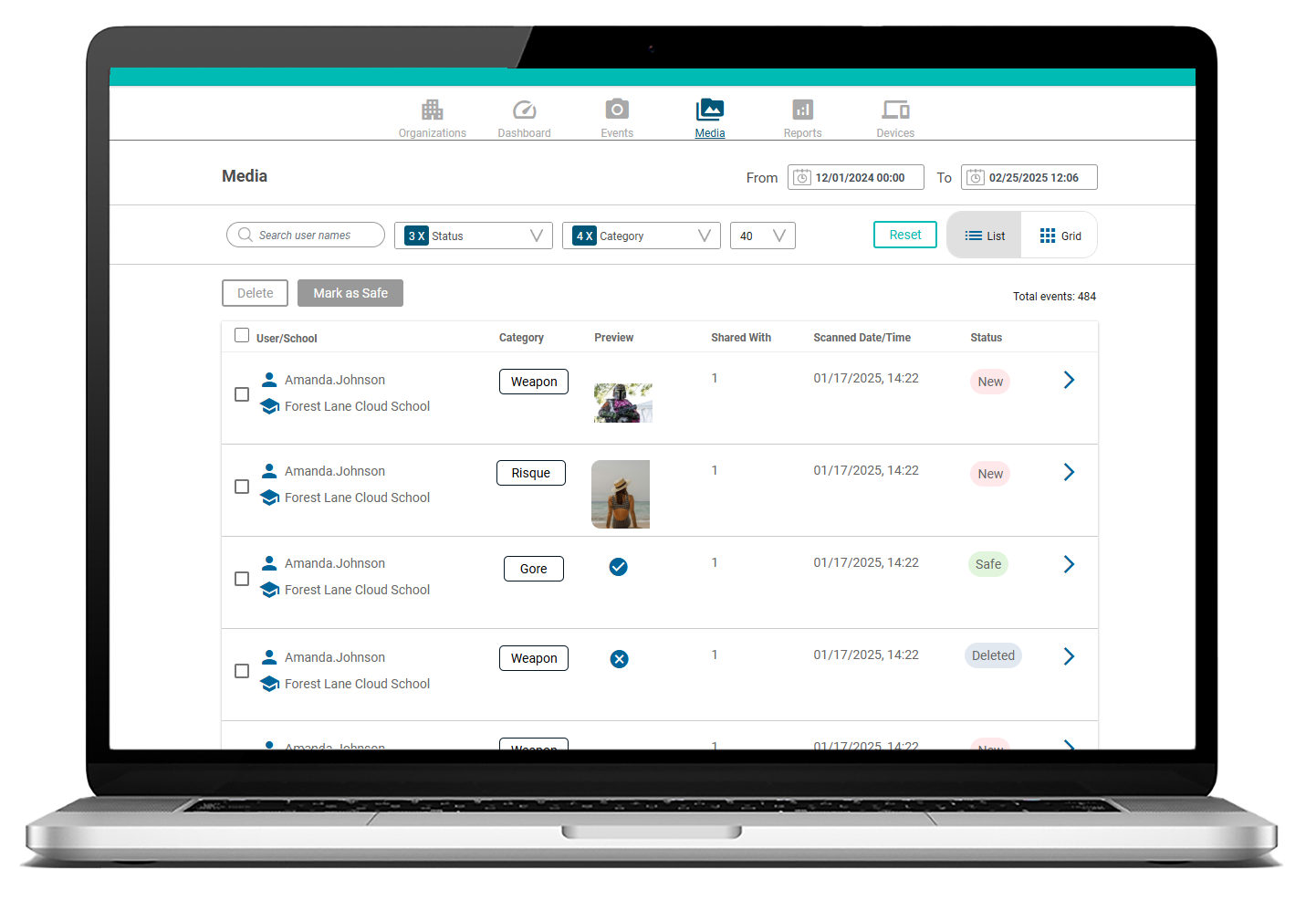

Platform expansion to automate core functions

According to NJSIG, the expanded use of Origami’s system is intended to streamline administrative processes and reduce manual workloads. The platform is designed to offer automation, data management, and reporting tools through a multi-tenant SaaS model.

Jeffrey Cook, information systems manager at NJSIG, said:

“Origami’s solution has enabled us to rapidly transform our claim operations, and we’re excited about adding our policy administration and billing process to the platform. We’re pleased that Origami’s policy system was very competitive on cost, especially considering the multiple product features available. We also value the platform’s robust reporting capabilities and its flexibility with rating methodologies.”

No implementation timeline disclosed

While NJSIG confirmed its intention to integrate the additional platform features, no details were provided regarding the rollout schedule or how the group will transition from any existing systems.

Origami Risk has described the expansion as part of a broader strategy to support core insurance functions through configurable digital tools.

Mike Kaplan, president of the Core Solutions division at Origami Risk, said:

“We’re excited about expanding our relationship with NJSIG to bring automation and technology-based solutions that represent key enhancements to their core functions. These capabilities are among several innovative solutions we’ve developed to help carriers and other insurance providers drive efficiencies across critical functions, meet customer needs and improve overall performance.”