Metro Credit Union teams up with Greenlight to teach kids money skills with hands-on finance tools

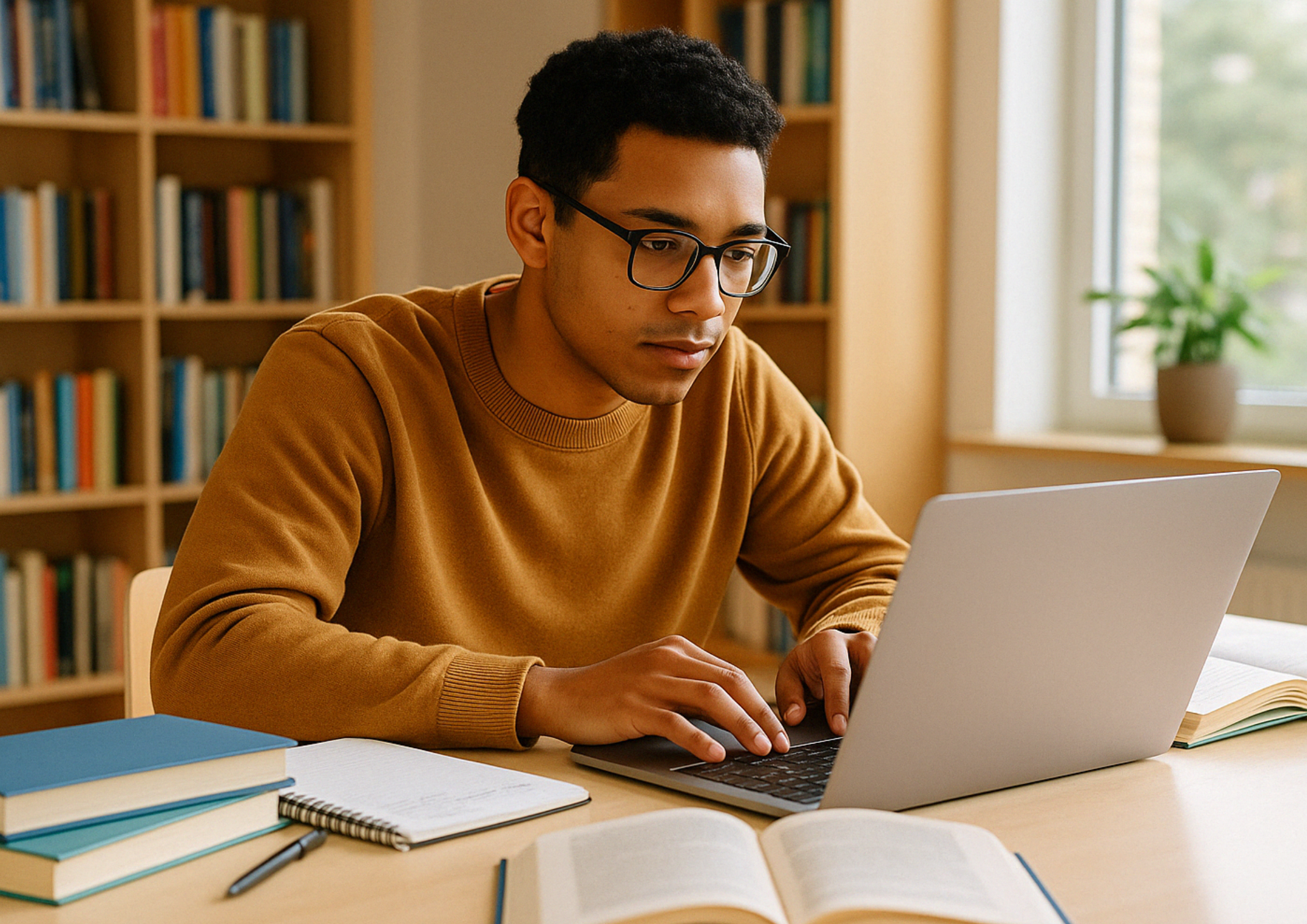

Free access to Greenlight's debit card and app aims to help parents teach kids about money management

Metro Credit Union has partnered with family finance platform Greenlight to offer its members free access to a suite of financial education tools for children and teens.

Through the collaboration, families will be able to access the Greenlight app and debit card, tools designed to introduce practical money management under parental supervision.

Based in Massachusetts, Metro Credit Union is the state’s largest state-chartered credit union, serving nearly 200,000 members. Greenlight provides a financial literacy platform used by over six million families, offering tools such as automated allowance payments, spending controls, and educational games through its Level Up feature.

Financial literacy gap and parental needs

The move follows growing concern over gaps in financial education. According to data cited by Greenlight, 91 percent of children and teens say they need better financial skills to reach their goals, while 94 percent of parents agree. However, only 35 states currently require a personal finance course for students.

Parents also report difficulty teaching personal finance at home. In a 2023 survey, 81 percent said they lack the tools and resources needed to guide their children on topics such as saving, spending, and budgeting.

Through the Greenlight app, Metro Credit Union members will be able to manage chores, send money instantly, set flexible spending controls, and receive real-time alerts. The app also includes a gamified curriculum that rewards users for completing financial literacy challenges.

Robert Cashman, president and CEO at Metro Credit Union, says: “Empowering our members through financial education is central to what we do at Metro. We're excited to partner with Greenlight to introduce essential money management skills for kids and teens. Our partnership offers Metro members opportunities to teach their children about money and set them up for future success.”