Pearson reports Interim Results for first half of 2024 with steady growth

Global education giant Pearson has published its unaudited interim results for the six months ending 30 June 2024, reporting stable revenue growth and robust performance in its assessment and qualifications divisions.

For the first half of 2024, Pearson reported a revenue of £1.8 billion, reflecting a 2% increase on an underlying basis. Adjusted operating profit rose to £206 million, marking a 5% increase.

These improvements were attributed to cost management and efficiency gains. However, statutory operating profit saw a decline to £146 million from £156 million in the same period last year, primarily due to restructuring costs.

Sector Highlights

The company's assessment and qualifications division experienced significant growth, with revenues increasing by 6% on an underlying basis. This was driven by strong demand in clinical assessments, UK qualifications, and US student assessment services.

Andy Bird, CEO of Pearson, stated, “Our assessment and qualifications business continues to perform well, reflecting our commitment to delivering high-quality, reliable services to our customers.”

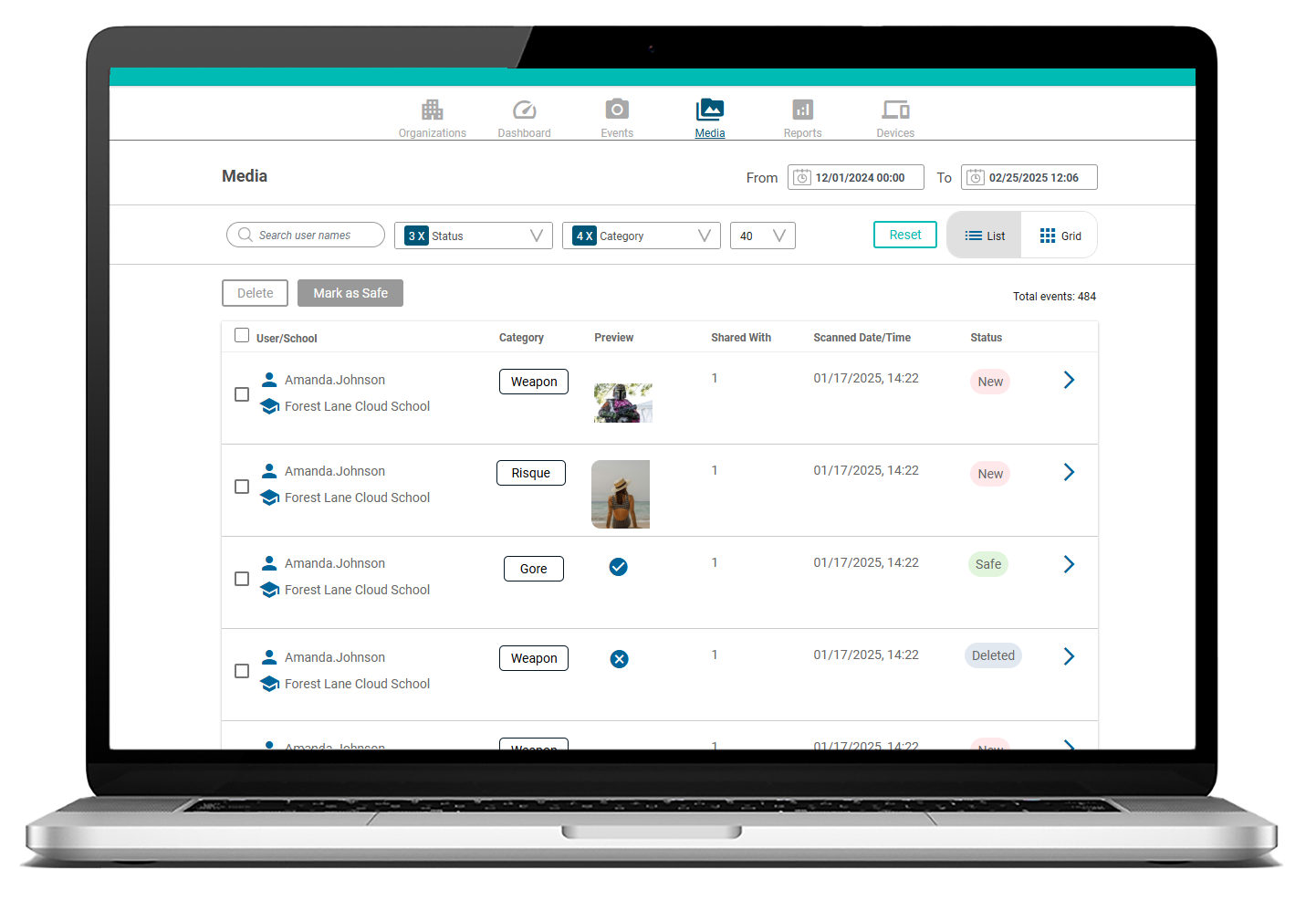

Virtual learning also showed positive momentum, with a 5% increase in revenue on an underlying basis. Pearson credits this growth to ongoing investments in online learning platforms and services, meeting the increasing demand for flexible learning solutions.

Pearson has been actively enhancing its digital capabilities and expanding its product range to drive long-term growth. Several new initiatives were launched to innovate and meet the evolving needs of learners and educators globally.

Bird commented, “We are investing in our digital infrastructure and expanding our product suite to ensure we meet the evolving needs of learners and educators worldwide.”

Despite a 3% revenue decline in the workforce skills division, attributed to regional demand fluctuations, Pearson remains optimistic. Bird added, “Despite the short-term challenges, we are confident in the strategic direction of our workforce skills division and its ability to deliver value in the future.”

Financial Stability and Outlook

Pearson's financial position remains strong, with net debt reduced to £421 million from £517 million at the end of December 2023. Free cash flow stood at £110 million, indicating strong cash generation and effective working capital management.

Looking forward, Pearson expects continued growth in its core sectors and maintains a focus on cost control and operational efficiency. The company has reiterated its full-year guidance, anticipating mid-single-digit revenue growth and further improvements in adjusted operating profit margins.

Andy Bird concluded, “Our first-half performance underscores the strength of our business and our ability to adapt to changing market conditions. We remain committed to our strategic priorities and are confident in our capacity to drive sustainable growth and innovation in education.”