RM navigates revenue drop with profit surge and strategic growth in EdTech and assessment

RM, a global edtech provider specializing in digital learning and assessment solutions, has reported its full-year financial results for FY24, highlighting improved profitability despite a decline in revenue.

The company’s total revenue from continuing operations fell 14.9% to £166.1 million, primarily due to the closure of its loss-making Consortium division and challenging market conditions in the education sector.

Despite the revenue drop, RM recorded a significant improvement in profitability, with an adjusted operating profit of £8.6 million, compared to just £0.3 million in FY23. The increase was driven by the elimination of losses from the Consortium division and stronger contributions from RM’s remaining business units - Assessment, TTS, and Technology.

Statutory loss after tax narrowed to £4.7 million, an 83.7% improvement from the £29.1 million loss in FY23. Adjusted EBITDA rose 87.2% to £13.1 million, though it was down 12.9% when compared to restated FY23 figures.

Debt position and cash flow improvements

RM’s adjusted net debt increased to £51.7 million, reflecting a £6 million investment in its global accreditation platform. However, the company’s net cash generated from operating activities saw an £18.9 million improvement, leading to an £8.4 million cash inflow in FY24. RM stated that its debt levels were better than market expectations, and it continues to operate within its banking covenants with ongoing lender support.

Assessment division secures key contracts

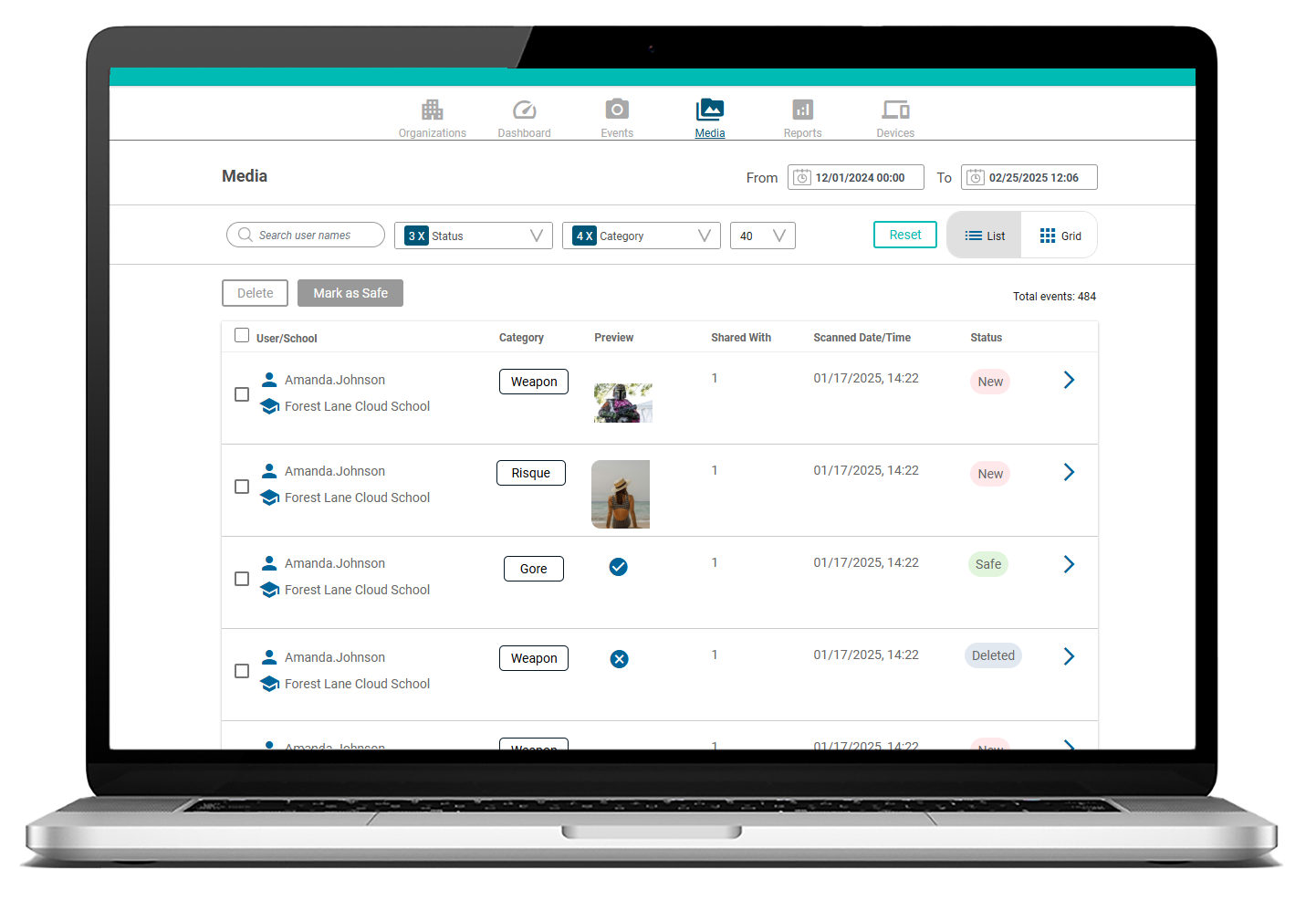

The company’s Assessment division recorded strong performance, with its contracted order book more than doubling to £95.7 million (up from £40.8 million in FY23). RM secured two major digital assessment contracts with International Baccalaureate (IB) and Cambridge University Press & Assessment (CUPA), reinforcing its strategic focus on digital transformation in education.

Additionally, RM successfully renewed 99% of its core assessment contracts up for renewal, securing 78% of its annual revenue for the segment. Other key performance indicators (KPIs) for the division included:

12% year-over-year growth in assessment digital platform revenue.

10% year-over-year growth in repeatable revenue, including scanning services.

21 million tests processed through RM’s digital assessment platforms, up from 19 million in FY23.

TTS and technology segments adapt to market challenges

RM’s TTS division focused on expanding its product portfolio, launching 124 new proprietary products in FY24. The company also integrated AI-driven learning tools to align its 9,000+ TTS products with national curriculum standards. However, international sales were impacted by budget uncertainty in key markets, largely due to election cycles.

The Technology division shifted its strategy toward longer-term contracts with multi-academy trusts, improving its profitability. New managed services contract wins in H2 FY24 are expected to positively impact revenue in FY25.

Cost savings and strategic realignment

As part of its transformation strategy, RM implemented £10.6 million in annualized cost savings by:

Closing unneeded office space and consolidating warehousing.

Streamlining operations to improve efficiency and customer service.

Eliminating losses by shutting down the Consortium division.

RM has fully established its new operating model and management team, including the appointment of Dr. Grainne Watson as COO.

The company stated that early FY25 trading is in line with market expectations, with a strong focus on reducing net debt while continuing to invest in its core Assessment division.

CEO Mark Cook commented on the company’s transformation:

"This has been a year of transformation for RM, and the success of our strategy is already reflected in the progress we have made driving profitability and growing our contracted order book. Looking ahead, significantly reducing net debt is a priority, and we are evaluating ways to achieve that while ensuring that we pave the way for sustainable future growth in our core business."